Silver IRA Rollover Companies: Comparison, Fees, Reviews

Simply transfer funds from your existing IRA into a self directed IRA account, choose a depository who can provide storage, then buy the physical metals you want. Additionally, security of your investments should always be paramount when making decisions regarding retirement savings. Silver has historically performed well during times of economic uncertainty and inflation, making it an attractive investment option for those looking to protect their wealth. In a self directed IRA, you may liquidate your holdings by contacting our trading desk to lock in a “sell” order. So, before you look at a company’s minimums, you should check what others are saying about the firm first. The bottom line is that Gold IRA investors can move some or all of their existing retirement savings into physical Gold without paying any taxes or penalties in the process. Individual Investors: Book a meeting. However, customers are often encouraged to purchase numismatic coins with premiums that can range from 40 percent to 200 percent above the spot price. ” Francis Bruno Hyattsville, Maryland. AHM Super Silver Plus, $234 per month. It reinforces its customers’ confidence further by offering fair pricing, as well as 7 day price protection on premium coins and zero fees for up to 10 years. Goldco reviewers on ConsumerAffairs continue the excellent review trend as well. They also have a great buyback program. We recommend working with dealers who know and understand the purchase of precious metals with retirement funds.

Precious Metal IRA Custodians

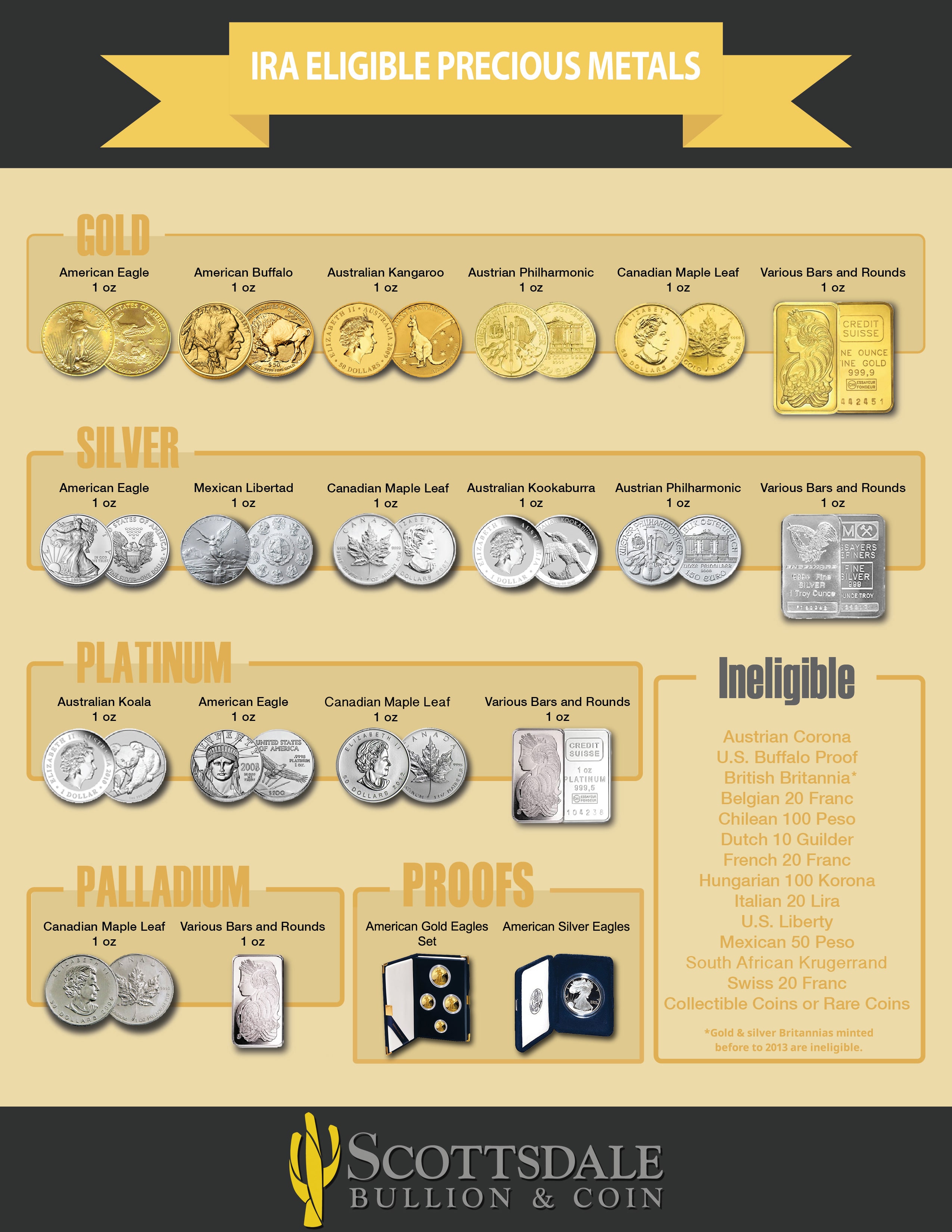

Environmental, social, and governance ESG scores are provided for more than 2,000 assets on the platform. The Vienna Philharmonic was first offered on October 10, 1989, and was initially minted in two sizes: one ounce and one quarter ounce. This allows for all the gains on the metals, once outside the plan to be realized when inherited. Avoid common and costly mistakes when investing in Precious Metals by reading this free guide. Analysts estimate prices to reach $2200 in 2021, providing a return of about 25%. A: Investing in a gold backed IRA offers a number of potential benefits. Just as with platinum, palladium fineness must also reach a minimum 99. A lot even have platinum and palladium coins as well. Their team of professionals is highly experienced and knowledgeable in all aspects of gold IRA investing. Join the Gold Alliance and Unlock Your Full Potential Today. Physical precious metals is a self directed investment and generally requires a custodian that offers self directed IRA investments. It’s important to note that each of these metals has certain fineness requirements as per the Internal Revenue Code.

Recent Posts

Unlike conventional retirement accounts such as IRA and 401k accounts that limit your options in standard paper based assets such stocks, mutual funds and bonds, a Gold IRA allows you the added benefit this article of investing in physical Gold coins and bars. Mint listed dealer in southern California. Click here for more info. Gold, Silver and Platinum IRA: 2. The internet is full of websites promoting “Home Storage” Gold IRAs, “Self Storage” Gold IRAs, “Home Delivery” Gold IRAs, and other enticing captions that lead consumers to believe current law allows them to store gold and silver held in their IRAs at home. The purpose of a gold and silver IRA is to provide a hedge against inflation and economic instability. If you do not consent to receive text messages and emails from Equity Trust and seek information, contact us at 855 233 4382. Several account types are eligible for conversion into a gold IRA.

Software and Business

If the work in the first draw is complete, the lender releases the money for that draw, to reimburse you. Fortunately, it’s as if he was reading my mind. All opinions and views are of the advertiser and do not reflect the same of WRTV. Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments. I was born in 1982 and when I think about the 20% mortgage rates in the early 80s my parents had to deal with it makes me crazy. US Precious Metals is one of America’s most trusted coin companies. We sourced feedback and reviews from real consumers and consulted with finance experts. Gold IRA companies tend to form strategic alliances with traditional IRA custodians, accredited depositories, and wholesale metal dealers. Trading on margin increases the financial risks. GoldBroker offers a great way to diversify retirement portfolios with gold and silver, providing customers with peace of mind and security. The price of gold has risen steadily over time, reaching its highest price ever in 2020. This account executive will stay with you as long as you have an IRA with Birch Gold Group, meaning that you’ll develop a relationship, and the executive will understand your financial needs and goals.

Q What are the mechanics of a gold rollover?

Click here to apply for wholesale pricing. © Goldcore Ltd 2003 2023. Secure Your Retirement with Advantage Gold’s Expert Gold IRA Services Start Planning for Your Future Today. They will describe each choice in detail and make recommendations based on your investing goals and current situation. Be sure to look for gold IRA companies that have a good track record and have been in business for many years. Founded in 2006, Goldco is another highly rated gold IRA provider. Other eligibility conditions include. When it comes to retirement planning, incorporating gold into your portfolio is a smart move. Accounts above $200,000 usually attract a service fee of $225. To pick the best possible option for your situation, there are a few factors that you have to consider. Reading reviews is great. The company chose Texas as its storage location for a few reasons. What is segregated storage.

You’re in! Click here to download the security deposit cheat sheet

CA resident license no. They have secured more than $1 billion in precious metals for their clients. Traditional 401k plans and IRA’s are tax deferred savings accounts, meaning you do not need to pay any taxes on your contributions. An IRA individual retirement account is a personal retirement savings plan with tax benefits and various investment options. Contributions to a precious metals IRA can be deducted from your taxable income, reducing the tax bill. You can take advantage of these legal incentives, but consider the help of a qualifying custodian. This company is regarded as a market leader when it comes to precious metals IRAs. Goldco: Best for 401k/IRA Rollovers, Best Customer Service. Every customer will work directly with one of Patriot Gold Group’s owners, providing a personalized experience. Once payment has been received, we will ship directly to your depository. If you actually want to explore this, please do some additional due diligence. If they cannot buy it back quickly and easily, you can’t take advantage of the best spot prices at the time of sale. Discover the Benefits of GoldCo Try It Now.

American Hartford Gold Review

Investing in your retirement is one of the most important things you will ever do. However, unlike traditional IRAs which focus on paper based assets such as bonds, EFTs, funds, stocks, and other cash equivalents, gold IRAs only hold physical gold or other approved precious metals. See the full list of IRA approved gold coins. By considering the factors mentioned above and researching highly rated companies, investors can make informed decisions when choosing a gold IRA company. Additionally, Roth IRAs offer tax benefits and potential gains from long term growth without any early withdrawal penalties or minimum distributions required during retirement years. Orion Metal Exchange charges a $150 annual fee to accounts with a balance equal to or higher than $200,000 and $225 per year for accounts with a lower balance. The price of gold may fluctuate in the short term, but it tends to hold its value over time and has proven to be an inflation hedge.

Augusta Precious Metals: Best Overall

Invest in Your Future with Birch Gold Group: Secure Your Financial Freedom Today. The firm also ensures all the precious metals in their product listing are up to IRS standards, i. No, this is considered a prohibited transaction because you are a disqualified person. First and most important: Check the Better Business Bureau’s profile on a company before doing business with it. Just make sure you invest with a reputable gold IRA company who you feel comfortable with. Remember: no other method of portfolio diversification offers investors as much potential as investing in precious metals. These two accounts differ in how your contributions are taxed and how withdrawals are taxed. Discover the Benefits of Investing with American Hartford Gold Group Today. The IRS has a list of approved storage depositories. >>> Click here for Free Gold IRA Kit <<<. Five star Endorsements. You are leaving the Altra Federal Credit Union website and entering. Also, you can leverage your physical gold bullion to buy some government bonds.

Conclusion Gold IRA

Assessment of implications and costs of business restructuring. There are many rules about what transactions you can do and which ones you cannot. They should also provide clear and concise information about the account and the investments made. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. All opinions and views are of the advertiser and do not reflect the same of WRTV. The following list includes some of the best companies out there. With their commitment to providing quality service and products, Noble Gold is an excellent choice for anyone looking to invest in gold and silver IRAs.

Investment Options

Additionally, gold and silver IRAs are subject to the same tax rules as other retirement accounts, so investors should consult a tax professional to ensure they are in compliance with the applicable regulations. Today, Become has more than 50 lending partners Prospa and OnDeck included. GoldCo also offers quick and secure gold IRA transfers, allowing customers to quickly and easily move their gold investments. It allows you to transfer funds from an existing retirement account into a gold IRA, giving you the opportunity to diversify your portfolio and protect your wealth. This will help determine if this is the best investment for your situation. How to Move 401k to Gold Without Penalty. In addition, a bar or round must be produced by an accredited source. ” Robert and Nancy Nelson “John’s background, knowledge, respect and promptness made the entire process relaxed. Digital Financing Task Force does attempt to take a reasonable and good faith approach to maintaining objectivity towards providing referrals that are in the best interest of readers. Even if gold and other precious metals aren’t your main investment vehicle, you should look into gold IRAs to help diversify your investments in general. Discover the Benefits of Investing with Oxford Gold Group Today.

Client Log In

We may earn a small commission at no extra cost to you. While we work to update our silver coin inventory continually, you’ll often find. The downside of this is clients most likely won’t get as much money as they would if they invested in options that allowed them to get faster growth. Their expertise in gold investment and retirement planning is unparalleled, and their customer service is top notch. Gold IRA reviews typically focus on the different types of gold that are eligible for investment, such as American Eagle gold coins, Canadian Maple Leaf gold coins, and gold bullion bars. Fund your account: You’ll need to roll over funds from an existing retirement account into your new precious metals IRA. The rules for a traditional IRA applied to this one as well. A: Gold IRA accounts allow investors to purchase and store physical gold, silver, platinum and palladium. Discover the Benefits of Investing with Birch Gold Secure Your Financial Future Now. The value of the dollar will gradually decrease over time, and things will become more expensive. The US Congressmen Alex Mooney proposed that the US dollar be backed by gold because of the continued inflation we’re seeing across the country and the world. What we don’t like about Birch Gold Group: Set up fees and other specifics unavailable on their website.

PROS

In recent years, we’re seeing more Americans turn to gold and silver as safe haven investments. Silver can be used as a protectionary measure in times of economic uncertainty. FHA loans backed by the Federal Housing Administration are popular with first time home buyers. Birch Gold Group specializes in Precious Metals IRAs and strives to provide customers with the right information so they can make the appropriate decisions for their financial future. We will need to know: 1 Your IRA account number, and 2 The name of a contact person at your custodian. Please see ourEditorial Guidelinesfor more information. What is segregated storage. They will then transfer funds from their existing retirement account into the new gold backed IRA. XML Sitemap Terms of Use Privacy Policy. Preserve Gold is a full service precious metals IRA dealer offering an extensive catalog of gold, silver, platinum, and palladium coins and bars available for purchase.

PAMP Suisse Silver Bar 1 kg, 100 oz

You can also check out our guides for the best retirement plans, the best traditional IRAs, and the best Roth IRAs. Long transaction clearing process that could potentially last a month. Roth precious metals IRAs let you make contributions after tax, but your withdrawals will be tax free. When people buy gold and silver for reasons other than opening a precious metal IRA, they can receive guidance from the professionals at the company. It’s also worth checking out ratings websites like Trust Pilot which allows verified reviewers to leave feedback on companies after using their services. Patriot Gold is one of the best gold IRA companies. We have built relationships with established custodians that have a fantastic track record from the Better Business Bureau and the flexibility to help you meet your specific retirement diversification goals. And they certainly won’t take the fall for people when the IRS disqualifies the scheme and demands tax and penalty on one’s entire precious metals holding. The fees usually range from $200 to $300 a year. Otherwise, gold IRAs are subject to the same tax benefits, limitations, and withdrawal penalties as traditional IRAs. Fill out the form: Fill out Patriot Gold Group’s quick online form, and a representative will contact you shortly to initiate your application. For example, no one can stop you if you want to use your IRA solely to store gold, and you can do so if you’re going to include some rare coins and bars in the account. Rolling over to the Silver IRA incurs no taxes and is completely approved by the IRS. Silver Coins/Bars/Bullion Minimum fineness required: 0.

PRECIOUS METALS FORMS

However, clients should keep in mind that the aforementioned silver IRA companies are the best ones in the industry according to numerous reviews. Ultimately, the choice is an individual one. This includes the Better Business Bureau BBB, Business Consumer Alliance BCA, Consumer Affairs, Google Reviews, TrustLink, and TrustPilot. When it comes to retirement planning, there are a lot of options out there. Invest in RC Bullion for a Secure Future and Enjoy the Benefits of Precious Metals Ownership Today. Additionally, you’re limited to just one rollover per year. In conclusion, a silver IRA can be a valuable addition to a retirement portfolio for those looking to diversify their investments and potentially hedge against economic instability. Review and Comparison of the top Precious Metals IRA Companies to store high value precious metals like gold and silver to your name. Gold IRA reviews can be a helpful tool in finding the right company for your needs. So, thanks to the recent hype, these schemes are now on the IRS’s radar. This is one of the most popular gold IRA providers with excellent reputation and zero complaints. Additionally, gold is a liquid asset and can be easily converted to cash. Doing your due diligence and researching different silver IRA companies can help you find one that is trustworthy and reliable, giving you peace of mind as you invest in your retirement future.

Disclaimer: The information provided on this page is for educational purposes only Refer to a professional for investment advice In some cases, we receive a commission from our partners Opinions are always our own

You only need to choose the self directed IRA custodian with whom you have the most confidence. After your approval, Midland will wire funds to the dealer and direct them to ship all metals to the depository. By: Paradise Media LLC. All purchases are covered by insurance, and the company provides expedited transportation of metals. You are only allowed one rollover per year. The company’s track record is impressive with a Better Business Bureau A+ rating and a 4. Noble Gold Investments is a relatively new player in the market for gold IRAs, having been established in 2016. If IRA rollovers are your biggest concern, then Regal Assets is the IRA Company you should approach. Precious metals can be held in your IRA in the form of physical allocated or unallocated gold and silver bullion, coins from specified countries, and certificates. A custodian is an official entity with the necessary licenses for administrating SDIRAs and storing gold and other precious metals purchased as an investment. In fact with around only 300,000 of them minted in 2016, this is among the most limited quantity silver dollars made in the whole world. If you held a large portion of this stock, you could be left with nothing.

Our Company

How to Move 401K to Gold Without Penalty. Noble Gold works with other businesses, including suppliers of precious metals. Although most mutual funds provide indirect exposure, they often provide greater diversity than direct investment in a single commodity. However you choose to store your gold, we recommend an option that insures your investment. 1Based on Rocket Mortgage data in comparison to public data records. One of the best aspects of investing in gold and silver is not only that they’re a hedge against inflation; they also protect people’s assets against deflation. For every transaction, customers deal directly with a company manager who is also a precious metals specialist. When you work with this company, you’ll gain access to a team of dedicated professionals who can answer your questions at any time and provide guidance throughout the process. Proper storage is crucial to ensure the safety of the metals. If we cannot add value, we’ll say so, and, when we are confident, we’ll share that too. For many, investing in precious metals is a critical part of retirement planning. GoldCo 401k Precious Metals Rollover 3. Very few companies maintain their own storage depositories, so most partner with third party depositories approved by the IRS for the secure storage of precious metals held in IRAs. Customers receive specialized attention from every department.

Disclaimer: The information provided on this page is for educational purposes only Refer to a professional for investment advice In some cases, we receive a commission from our partners Opinions are always our own

The first step in a Gold IRA rollover is to open a new Gold IRA account with a reputable custodian or broker. Designed for the Royal Canadian Mint by Denis Mayer Jr. A Gold IRA rollover is a process of transferring funds from a traditional IRA or 401k retirement account to a self directed IRA that allows investment in precious metals, including gold. If recent events have proven anything, then it is the fact that our economy isn’t as safe and secure as we would like it to be. In the event you pass away, your IRA and its assets will be transferred to your IRA beneficiary or beneficiaries. We couldn’t download the 25 page investor kit without providing a name, email, and phone number, but we could access the company’s robust investor library, which gave us four eBooks explaining updated information for 2023. Various Precious Metals. In addition to that, the company has an excellent reputation for customer service. In order to meet the operating costs of operating this website, we may receive compensation when you click on links on our site. 204 Scottsdale, AZ 85260 Get Directions. Government sponsored retirement accounts require you to complete their own internal rollover documents. >>>>Visit American Hartford Now<<<<. Experience the Best with GoldCo: Invest in Quality and Security Today.